- PRACTICE FOR CHECKBOOK REGISTERS HOW TO

- PRACTICE FOR CHECKBOOK REGISTERS UPDATE

- PRACTICE FOR CHECKBOOK REGISTERS REGISTRATION

- PRACTICE FOR CHECKBOOK REGISTERS SOFTWARE

The advantages it offers in terms of budgeting, expense control, and financial security are undeniable, whether choosing a physical or digital check register.

We gain insight into our spending patterns, identify errors and fraud, and maintain an accurate financial record by meticulously recording transactions and routinely reconciling our accounts. Digital alternativesĪ check register is still a useful tool for keeping track of our finances, despite the temptation that the age of online banking and digital transactions may present. You may look back on previous transactions, settle disagreements, and keep track of your whole financial history by keeping these documents. Keep your checkbook and any associated bank statements in a safe place. This procedure guarantees the correctness of your financial records and aids in the fast detection of any errors or anomalies. Plan frequent times to reconcile your check register with your bank statements, such as monthly or bimonthly.

PRACTICE FOR CHECKBOOK REGISTERS UPDATE

This enables you to more effectively examine your spending habits and update your budget as necessary. If you want to keep track of various sorts of spending, think about adding categories or tags to your transactions. Mismanagement of finances and misunderstanding can result from poor record-keeping. Make sure that all data, including dates, sums, and descriptions, are entered accurately since accuracy is crucial. Make it a practice to record transactions as quickly as possible, if not instantly. This procedure aids in finding any missing or incorrect transactions, enabling prompt corrections. Compare the balance in your register to the bank's reported balance on a regular basis, noting any differences. It's critical to match up your check register and bank statements.

PRACTICE FOR CHECKBOOK REGISTERS REGISTRATION

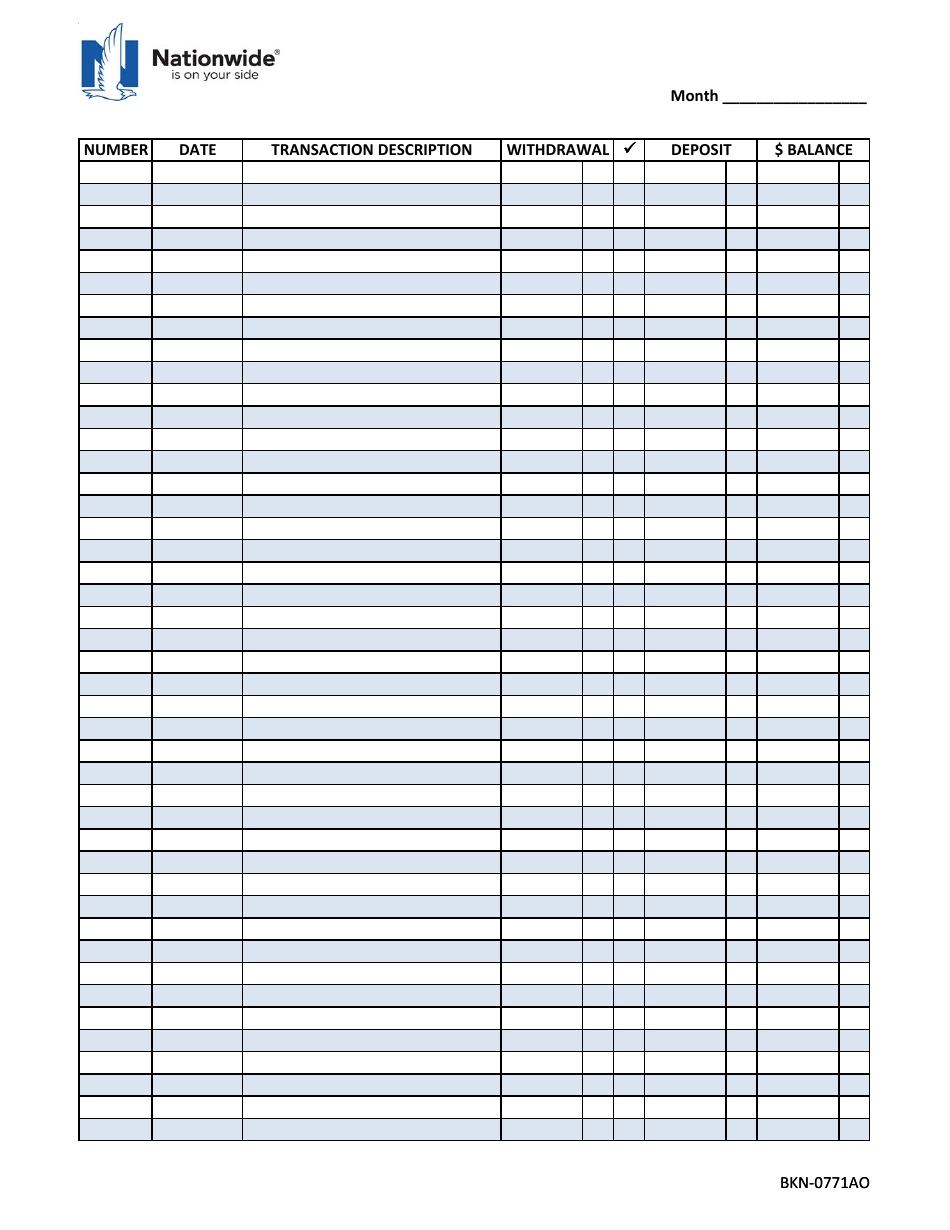

maintain updating your registration consistently and on a frequent basis to maintain it current. Double-check the amounts and descriptions to make sure they are accurate. Write down the pertinent information for each financial transaction in the appropriate columns of your check register. If more space is needed, add more columns, such as those for tracking costs or highlighting particular accounts or projects. Include headings for the date, the transaction description, the check number, the deposit, the withdrawal, and the balance. Label each column in your check register to start. Choose the format that best suits your needs and preferences.

PRACTICE FOR CHECKBOOK REGISTERS SOFTWARE

While digital options include templates in spreadsheet software or specialized personal finance applications, physical registers can be purchased at stationery stores. There are physical and digital check registers available.

PRACTICE FOR CHECKBOOK REGISTERS HOW TO

How to create a personalized check register template? By comparing your register to bank statements, you can quickly detect and report any discrepancies, ensuring the security of your account. Keeping a check register adds another layer of security by assisting you in identifying any unauthorized transactions or errors. You can analyze your spending habits, spot areas where you can make cuts, and make wise decisions to better your budgeting and savings objectives by frequently going over your register. You can evaluate your financial inflows and outflows using a check register. You can accurately track your spending patterns, spot any discrepancies, and reconcile your account with bank statements by meticulously keeping track of every transaction. Your financial activities are fully documented in a check register. How is Check Register Used for Financial Evaluation? This acts as a guide or digital record-keeping system where you can document all monetary dealings, encompassing drafted checks, added deposits, ATM retrievals, online transfers, and debit card operations.Ī common bank register consists of fields to record the date, the portrayal of the transaction, the check number (if relevant), the sum of the deposit or withdrawal, as well as the current balance. What is included in check register tracking?Ī check register is an uncomplicated, yet effective method of monitoring and documenting transactions associated with your checking account. Understanding the function and advantages of a check register will help you achieve better control over your financial activities, whether you prefer the simplicity of pen and paper or use computerized techniques. A check register is still a useful tool for keeping track of and managing personal funds. It's simple to ignore the significance of keeping a check register in the current digital era, where mobile apps and Internet banking have become the norm. What is The Purpose of the Check Register?

0 kommentar(er)

0 kommentar(er)